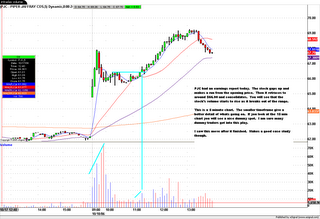

I am not a swing trader but I do see the significance of volume in the intraday charts also. I have a intraday chart of PJC. You can clearly see how volume gives clues to the impending move.

When you look at the charts, these trades will look very easy. When you are actually trading it is not easy to see the move when it forms. Trading is a probability game. Using volume as an indicator will help increase your odds but there is still a chance for loss. That is were the stop loss comes into play.

No comments:

Post a Comment