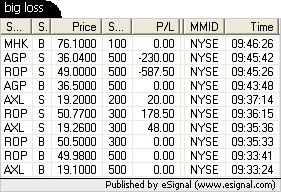

I had a really nasty lost this morning. I let a $500 profit turn into a $409 loss. I had ample time to get out but I fell in love with my position. I believed that the stock would make a bounce and make new highs. I wanted to ride a $1+ move. Even when it broke below my average price I held on to 500 shares. Here is what I was thinking. I was hoping that it would make a bounce. It should because it was so strong earlier. I got out right at the lows. This rule comes into my mind. Never let a winning trade turn into a loser.

After I got hit with the big $587.50 loser I compounded my error by getting into another $230 loser. That trade was an impulse trade which I took because I desparately want to come back from my earlier loss. Like any other impulse trades I bought at the top of a spike and the stock quickly traded back down. I was down close to $600, just 15 minutes after the open. All this could have been avoided if I hadn't pulled my stop.

2 comments:

I get an error when I try to view the chart.

Thank you.

Are you still having problem seeing the chart? I checked the chart and it worked find with firefox and internet explorer?

Post a Comment