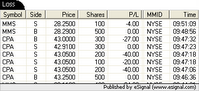

I started out great and was up $295 in the first 15 minutes. Then I got a string of losers that took all my gains away. One bad trade in CPA set me off in a downward spiral. I tried to buy the break of 43 with a market order and got filled at 43.25. I should have closed my trade but I hesitated choosing to wait and see if it would move higher. The stock had no bids and dropped like a rock. After the loss I kept thinking about the money lost and how much I would have been up if I had not taken the trade. I just kept losing after that. I found myself actually down $35 at one point.

I managed to recover my poise a bit later and made $250 back with a short in MMS and a scalp in ARM when it had a little spike to 17.80. Then I make another blunder putting on a trade in CME, a $500 dollar stock. I lost $118 on a 200 share position. I was back under $200 again, and I was getting annoyed. I had a great entry in ESE but messed up the trade by getting out too soon. I was in at 45.19 When I was up over $200 again I was looking for a reason to get out of the trade. When a 4k offer came in I got out at 45.40.

I was up $250 again after the ESE trade but after some churning I am $180 for the day. I have this habit of watching my pnl and it is affecting my trading. Focus on the setups and the money will come.

3 comments:

Great Trade on (ESE) but you need to watch the volume and that 5MDA. When you entered the trade you didn't even have significant resistance until $45.80 (the long opening candle). You should have kept a tight stop loss, and let that winner run. Check out

http://traderjamie.blogspot.com.

His latest entry show a nice GAP up play in which in watches the volume teeder off, then pick right back up, use the 5DMA as support, and then explode higher. Good Trade, it was in the green.

Thanks,

CalTrader

Thanks for your analysis. One of the main problems I have is focusing too closely on the tape. I got shaken out for some reason.

now that's lovely, great job!

Post a Comment